Panopticon Rising

I’ve written in the past about the fine data visualization products of Panopticon—one of the few commercial software vendors that understands data visualization. Having not seen the latest releases of their products for a while, I recently contacted the folks at Panopticon to request a product briefing. In addition to learning about the latest features during the briefing, I discovered that Panopticon experienced a tough couple of years since I’d talked with them last, which was a direct result of the recent financial meltdown. Unfortunately, most of Panopticon’s customers were financial corporations, so the meltdown hit them especially hard. I mention this only to help you fully appreciate what they’ve managed to accomplish in the last two years, despite a reduced workforce.

In its early years, Panopticon specialized exclusively in treemap visualizations—beautifully designed and comprehensively functional—which could be updated using real-time streaming data. When I looked at their products a little over two years ago, they had expanded their repertoire of visualizations to include line graphs, bar graphs, and an innovative way to compare a large number of time series on a single screen by merging line graphs and heat maps to form a new visualization called the horizon graph. I wrote about the horizon graph back in June of 2008 in a newsletter article titled “Time On the Horizon.”

During the past two years they’ve added almost every other type of visualization to their library that’s typically useful for quantitative analysis and performance monitoring, including my bullet graphs and Tufte’s sparklines. Many charts can be combined on a single screen with exceptional layout flexibility, and they can all work together, for instance, through the use of dynamic filters that affect all charts simultaneously. And finally, they’ve added the ability to display small multiples in the form of visual crosstabs. The result is a fine data visualization toolset for building powerful analytical applications and performance monitoring dashboards, developed by a lean team of talented designers and developers who have their priorities straight, rooted firmly in best practices. The toolset still lacks areas of functionality that would be useful, but its moving in the right direction at a rapid pace.

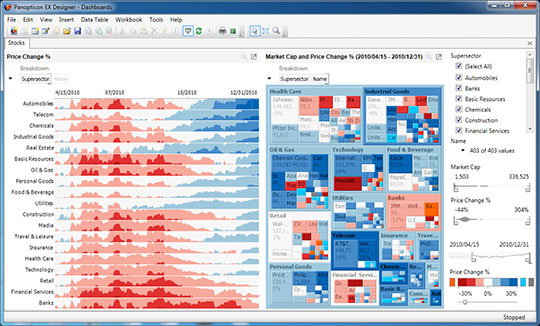

The following example combines a treemap in the middle, which displays market cap and price change information for a large set of stocks by sector, with a horizon graph on the left, which displays nine months worth of daily price change values per sector. Filter controls appear on the right for sectors (a categorical variable filtered using check boxes), market cap and price change percentage (two quantitative variables filtered using slider controls), and date (filtered using a date slider control).

Notice that the slider controls themselves provide information. The quantitative filter controls displays something that looks a bit like a histogram along the scale to show the frequency distribution of values in the data set, and the date filter control includes a sparkline to provide a simple view of how stock price changes went up and down through time.

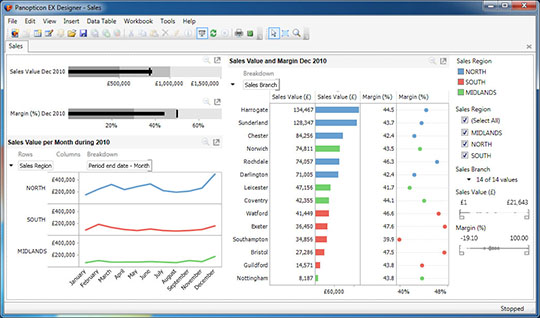

This next example combines bullet graphs, line graphs, a bar graph, and a dot plot to display sales information by region:

Panopticon’s products are not designed for exploratory data analysis. Business users wouldn’t explore data with them in an open-ended manner without some up-front development work done first by someone who has developed some skill in using the tool. The creation and layout of visualizations on the screen requires too much interaction with dialog boxes—each filled with many choices—to support the fast and fluid interaction with data that’s needed for exploratory data analysis. Instead, these products are primarily designed as toolsets that developers can easily learn to use for building specialized reporting systems, performance monitoring dashboards, and custom analytical applications. (If you’re unclear about the distinction between exploratory data analysis tools and custom analytical applications, I wrote an article in October of 2009, titled “Fundamental Differences in Analytical Tools” that explained the differences and how each would be used.)

Panopticon’s products don’t do everything, but what they do, they do well, as I hope you can see.

Take care,

7 Comments on “Panopticon Rising”

I was just at a course on MicroStrategy and a lot of the controls and graphs that are on the two images above also appear in their product.

While I don’t know/think that MicroStrategy is the greatest/best product, I think it does a decent job of visualization. Ever had a look at it?

Fesh,

MicroStrategy does not appear to handle data visualization any better than the other big BI vendors. Like the others, they have tried to emulate what they’ve seen vendors like Tableau, Spotfire, and Panopticon doing, but they’re attempts have developed from a superficial understanding of data visualization. This results in silly mistakes. Adding display widgets to your library of charts does not require expertise. Developing products that provide a rich overall data sensemaking experience does.

Stephen,

Quick question, if you had to choose ONE vendor, which one would you say is the best (as everything, it’s a relative term of course): Tableau, Spotfire, Panopticon and (maybe) QlikView. I’m trying to somehow settle on one of these providers and having a bit of a hard time choosing.

Overall, I do know that all of them can do a good job, but still, if you had to choose only one, which one would it be?

Thanks so much in advance!

Roman,

I wouldn’t narrow the list of candidates to a single vendor without thoroughly understanding your requirements, which I couldn’t do without investing more time than I have for interactions on this blog. I’m sorry that I can’t provide an easy answer. I recommend that you look closely at each of these products in light of your needs. Don’t base your decision on vendor demonstrations alone. Take time to put your hands at least on the two products that look the best.

We did an evaluation of visual BI solutions out there. I love this post, shows others have similar challenges. We’re sharing some of our experiences.

First, Panopticon was very very hard to work with and not as transparent, even misleading at times. For e.g. there was a link that said download a trial for free. But then, there was a barrage of emails on who we were background etc but no actual trial! On the flip side, Pentaho was very responsive, Tableau was very responsive, Pentaho was the most open, and open source.

Second, we’re an agile shop based on scrum, and short time frames, and Panopticon was not the option they were not supportive was clearly not the way, hopefully they change.

Your review seems to be in favor, we would’ve loved to see the capability. They have strong advertising arm and long client list. But, also please caution other users on the challenges.

So, from a small startup POV or early stage company, I would not recommend using Panopticon as your founding BI product.

Spotfire, Tableau and Pentaho were others we looking at, Tableau was easiest, but also fairly locked down (and not a integration solution, from a code perspective).

Can someone recommend others out there.

Jason,

Thanks for your comments. I’ll make sure that the folks at Panopticon see them and will encourage them to respond. If by “founding BI product” you mean a product that handles a full spectrum of BI support, then Panopticon is definitely not a candidate. It is not a general-purpose BI product. It is a product for developing visual analysis and monitoring applications. Regarding Pentaho, keep in mind that it does not currently provide good data visualization support. What is offers is typical of most BI products, but can’t be compared to products like Tableau, Spotfire, and Panopticon in this respect.

Jason,

Thanks for your feedback on our evaluation process. We do offer a unique and specialized product and we’ve found that it’s critical for us to understand your requirements before we provide evaluation software. Therefore we do have to ask some questions to understand your needs and priorities. Then we can ensure you receive have both the correct edition of our product and the right amount of technical support for your evaluation. This process does take a bit of time at the beginning of the conversation but it ultimately saves time for everyone.

This is different from how other companies work, but the other firms you mentioned make good, general purpose products. A “blind” evaluation can work well for them. It sounds like you’ve found a good solution for your organization. Based on your description, I tend to doubt Panopticon would have been a good fit in any case; your priorities and needs are a better fit for a more general purpose BI tool. I do understand the points you raised and we’ll see what we can do to make our messaging clearer about how our evaluation process works.