The Euro Crisis Is Less Complicated Than It Appears

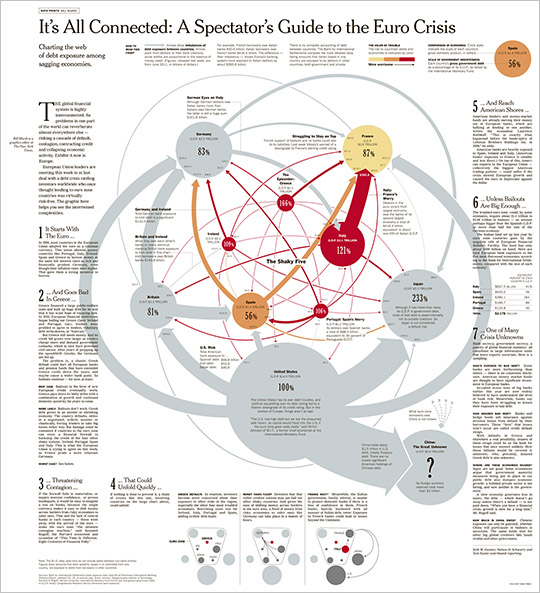

A few days ago I received an email from Thomas Watkins, who is an avid reader of this blog and a past participant in one of my Visual Business Intelligence Workshops. He asked my opinion of this infographic, which recently appeared in the New York Times.

It looks a bit like a solar system with really strange orbits. Displayed as a node-link diagram, the information seems quite complex—much more so than necessary. Rather than responding to Thomas with my opinion, I asked for his. As a highly-motivated student of data visualization, Thomas volunteered to provide more than I asked: “I started to write my thoughts, and I figured it would be better if I tried to actually attempt a redesign.” Three days later, he emailed me the following:

In the original graph by Bill Marsh of The New York Times, the first thing that jumps out at me is that it’s difficult to understand what’s even going on. I think The New York Times editing staff realized this, because they offer a fairly lengthy breakdown demystifying the visualization. This graph suffers from the classic problem of encoding quantitative values as area instead of length or 2D location. Trying to figure out which countries owe debt to other countries and the amount owed requires the reader to carefully trace arrows from one bubble to another. The graph also doesn’t even attempt to visually encode the very important metric of ‘debt to GDP ratio’; rather, they put the percentage in each bubble. Perhaps there was no more room left to graph it considering the busyness of the current design.

If the purpose of this graph is to convey the feeling of mass confusion that’s associated with the current financial crisis, then maybe it does make sense to use a wild array of bubbles and lines. However, if we want to communicate the broad picture while allowing specific visual comparisons to be made easily, then this visualization could’ve been designed more effectively. Overall I think it succeeds more as a diagram than as a graph.

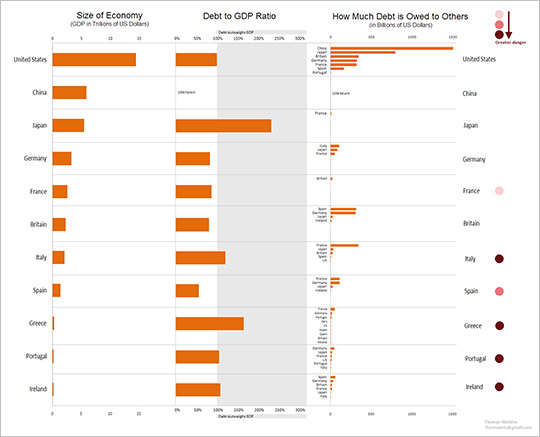

Thomas then went on to propose the following visualization as a replacement, minus the textual narrative that would be helpful to tell the story completely.

Thomas explains his version of the story as follows:

In my redesign I used horizontal bar graphs to rank each country by the size of their economy. Next I made a column for the ‘debt to GDP’ ratio. I figured that the two most important messages regarding this metric were (1) how high the ratio is, and (2) the ratio’s deviation from 100%. Therefore I made it a bar graph with a reference region. For the 3rd column I nested a set of ranked horizontal bar graphs within each country’s row. Finally, I plotted a simple dot next to each of the “worrisome” countries to indicate the ‘color of trouble’ from the original graph. My color of trouble varied on color intensity rather than hue to promote continuous rather than categorical perception.

I found Thomas’ version far superior to the original. What’s more, using Thomas’ design, additional metrics could be added to the display to enrich the story without overcomplicating it. Perhaps my friends at the New York Times should hire Thomas as an adviser.

Take care,

(Author’s note, upon further reflection: I realize now on Sunday, November 13th that I should have chosen my words more carefully in my original blog post when I described Thomas’ visualization as a “replacement” for the original network diagram that appeared in the New York Times. It is not a replacement in the sense that it intends to do what the original intended, but in the sense that it attempted to provide a more useful and effective visualization of the data; one that displays important information about the indebtedness of Euro zone countries to one another in an accessible way, which complements the story better than the original network diagram. Thomas’ visualization does not attempt to display the complex interconnectedness of debt. He created his own visualization because he found the original network diagram inaccessible and confusing. When he asked for my opinion of the original diagram, I had a similar reaction, which I have to most static node-and-link network visualizations that are designed for journalistic purposes: they look complicated and confusing, and as such do not invite readers to examine the data in useful ways. Network visualizations attempt to provide a synthesis of the many parts and relationships that make up a complex set of interconnections. They are difficult to decipher, in part because the information is itself complex, and in part because our brains cannot process a complex set of visual connections as a whole when displayed as nodes and links. When a network visualization is well designed, we can discern a few useful attributes regarding the whole—mostly outliers and a few predominant patterns. Beyond this, we must break the information down into parts and focus on them one at a time, which almost always requires the ability to interact with the visualization, such as by filtering out what’s not needed or by highlighting objects of focus in the context of the whole. I did not object to the original diagram that appeared in the New York Times because I felt that it was poorly designed, but because, in static form, it was not an effective use of static graphics to complement the story for its readers.)

40 Comments on “The Euro Crisis Is Less Complicated Than It Appears”

Bravo, Thomas. I particularly like that the New York Times version requires an explanation to make any sense of it*, whereas I didn’t need a single word of your explanation in order to make sense of your version.

* I can only assume the New York Times explanation was effective – me being an average reader with the attention span of a goldfish, I couldn’t be bothered to waste my time reading it. The marketing folks that constantly push these ineffective infographics would do well to consider that remark.

Thomas’ version definitely is far superior to the NYTimes’ version. So much so that I actually understood the chart, and now have a question. Why is Spain in greater danger of default than the US, given that its debt is well within its GDP range, while the US looks like it is at the 100% debt-to-GDP level?

I’m curious that the US shows no danger next to it compared to some of the others?

I agree with Steven’s assessment – Thomas’s version is better. I think it would be particularly interesting to add the debt service amount as a percentage of the annual Federal Budget to see just how acute the spending problem could be. Placing some kind of sensitivity parameter so that the user could vary the interest rate assumptions and see the resulting affects would also add. Very nice job!

Well done. Very clear now, although the “How much debt is owed to others” column is actually showing the ‘imbalances of debt exposure between countries’. On the NYTimes version how this is worked out is explained in the key at the top.

Remember that reading a newspaper has to be a joyful experience. Good thing we have the Bill Marsh’es to produce visualizations like the one he did for NYT, or we would be stuck in bargraph-land.

Effectiveness is not the major parameter by which to judge newspaper-stories.

The online-version of the NYT-version wasn’t a success though.

http://visualjournalism.com/print-or-online-one-masterpiece-and-one-screw-up/2011/10/23/

The rework is a far better presentation of the data because it is clearer and less confusing.

On the other hand, I think the original is better storytelling. Consider the title “It’s All Connected” and the subtitle referencing the “web of debt exposure.” The numbered sections walk the reader through a particular interpretation of the data. Thomas’s design choices do not reinforce that narrative, while the NYT original design does.

In my opinion, the two versions complement one another.

Gert,

You have an interesting perspective on journalism. I’m betting that the New York Times itself would not agree with you that a “joyful experience” should trump “effectiveness” in communication.

RKW,

People tend to use the term “storytelling” to mean different things and to judge its effectiveness using a broad range of criteria. Let’s not lose sight of the fact that this is journalism. Unlike other forms of storytelling, journalism is supposed to present the facts accurately in a way that readers can understand. The fact that the jumble of intertwining arrows fits the metaphors “It’s All Connected” and “web of debt exposure” is clever, but not good journalism.

I totally agree with Stephen that being a clever storyteller does not equate to good journalism in this case. It seems like the original design was intended specifically to tell an interesting story and NOT “present the facts accurately in a way that readers can understand.”

What the original version really needed were some context-preserving visual links!

Well, I would in all honesty be surprised if any visual journalist prefers the bargraph over the storytelling visualization-package. I’ll start asking around, and then you might do the same.

From experience, I would also be surprised to see an academic or business communicator choose anything but the bargraph ;-)

I’ll therefore have to disagree that journalism is just about presenting facts accurately in a way that readers can understand. We need different visualizations for different audiences. And only in very rare instances would I recommend to fill your pages with bargraphs, if you intend to reach a healthy percentage of your readers.

Did you guys really sit down and read the page? I had a wonderful time reading the text and learning from the graphic in a truly mixed experience, that I would never get from any ‘effective presentation’.

Gert,

I served as a judge at last year’s Malofiej conference in Spain, which is the premier journalistic infographics conference in the world. I understand the objectives of graphic journalism fairly well. A good graphic journalist would not hesitate to use a bar graph if that’s what would tell the story best. By the way, neither Thomas, who redesigned the NY Times graphic, nor I are making a case for bar graphs as the ultimate solution in all cases; instead we’re saying that journalistic infographics should present the information that supports the story clearly, accurately, and in a manner that readers can easily understand. If a bar graph does that best, then a bar graph should be used.

Your statement that you’d “be surprised to see an academic or business communicator choose anything but the bargraph [sic]” reveals that your experience is rather limited. Bar graphs are extremely useful for particular things, but they’re only one of the graphs that academics and business people frequently use. I take it you’re not an academic or a business person. What is it that you do that has made you such an avid defender of this NY Times graphic and such an opponent of bar graphs?

If you read what I wrote again, you’ll see that I did not say that “journalism is just about presenting facts accurately in a way that readers can understand.” Journalists strive for more than this. Nevertheless, if they do not communicate the facts clearly, accurately, and in a way that their readers can understand, they’ve fundamentally failed.

Thomas sat down and read the NY Times diagram very carefully; otherwise he would not have been able to redesign it. Unfortunately, I’m guessing that it took him an incredible amount of time to unravel the facts given the nature of its design. I’m sure that you did indeed have “a truly mixed experience” trying to make sense of the original diagram and I’m sure that you would have never had this mixed experience had you approached the same information in an “effective presentation.”

By the way, don’t assume from this critique that I don’t like the work of the NY Times. I believe that they have the most talented team of graphic journalists in the world. I count some of them as my friends. Even the best team, however, occasionally produces less than optimal work. This just happens to be one of those sub-optimal examples.

Tom,

Very funny. I didn’t get it at first. For those of you who are wondering, Tom is referring to my recent blog about the work that received the Best Paper award for information visualization research this year at VisWeek. Yes, a few “context-preserving visual links” is all the NY Times diagram would need to send readers screaming.

Fabulous graph, Thomas! Simple and elegant.

Pray tell, what software was used?

Hi Stephen. How are you? I know you were at Malofiej last year. We even sat at the same table for the final awardshow and had a fine conversation! (Don’t worry – I won’t hold your bad memory or lack of research against you).

On your blog and in your presentations you go in hard against selected pieces of work. Surely you can handle a bit of disagreement, twisting and civil argueing?

And sorry to say, but as long as you find the proposed bargraph far superior to the original visualization in accompanying this story, I’ll maintain, that I have a better understanding of journalistic visualization, than you do.

Of course I’ll be the first to acknowledge that my experience and biggest interest is not in the field of academic visualization. I try not to pose as an expert in fields, where I am not.

Oh – and we all love New York Times, don’t we? That’s part of the reason, why it’s so interesting to discuss the work they produce.

Stephen

No1 surely…

“journalistic infographics should present the information that supports the story clearly, accurately, and in a manner that readers can easily understand”

Gert,

I apologize for not recognizing your name. I welcome differences of opinion, but only find them helpful when they are clearly articulated with sound argument backed by evidence.

You wrote to me: “As long as you find the proposed bargraph [sic] far superior to the original visualization…accompanying this story, I’ll maintain that I have a better understanding of journalistic visualization than you do.” What matters is not which one of us has the better understanding. In a public forum such as this blog, what matters is that ideas are expressed in a way that we can learn from them. The three series of related bar graphs that Thomas created tell the story of how these countries compare to one another based on the size of their economy, their debt to GDP ratio, and the amount of debt that they owe to others, and it shows the relationships between borrowers and lenders. It does this in a way that is easy to perceive and comprehend. These same comparisons and relationships are difficult to perceive using the original NY Times diagram. Please explain why you believe the original diagram is superior and base your position on more than just opinion. If you feel that bar graphs should not be used in journalistic infographics, explain why.

Josh,

Thanks! I used Excel to make the graphs, and then I used a basic graphics editor (SnagIt Editor) to piece the graphs together. Nothing fancy.

Hi again,

I’m again having trouble agreeing with you, Stephen, on a chart comparison. I think I concur with Gert that the NYT version tells a more compelling story, the value of which outweighs any relative improvements the bar chart brings.

First, I realize there’s a lot of prose explaining the NYT article, which seems somewhat decried, but without that I don’t understand the bar chart at all either; at least let’s be honest about the criticisms levied against the NYT version having the same impact on the bar. Let me be precise: “Debt to GDP Ratio” is problematic. The legend in the top of the NYT article may be all that is required to explain it, but it IS required for both charts.

One is tempted to add the numbers in the “How Much Debt…” column and compare it to the “Size of Economy” (GDP) column in the Bar chart, expecting to see the middle number to pop out (Debt to GDP — this makes sense) but of course it doesn’t happen because the words do not adequately describe the numbers’ meaning. For example, the third column is misleading in the bar; it should be the Imbalance of Debt Exposure; it is not how much debt is owed. The legend clears this up nicely.

As for story telling, I agree with Gert. For one thing, this is an Opinion piece (if I read the NYT correctly). Journalistically (?!) I think that would give it some leeway towards story telling if that balance were to be argued. Even if not, though, the improvements in the story told by the NYT article are, in my opinion (which I respect is subjective) worth some relatively minor tradoffs.

For example, using line widths is, visually, less effective than a bar in most cases (although compared to the bars for how much Greece owes to others in the bar chart, I see little difference… the sorting is nice but the bars are too thin for any better a comparison than the line thicknesses are). Again I’m keen to prefer the labelled arrows to the non-labeled bars.

Even if labels were not allowed (per the visualization focus of this blog I’ll briefly defer), the NYT tells some interesting stories. Try, for example to find a loop in the NYT model (where country A is imbalanced to country B is imbalanced to country C is imbalanced back to country A). That was one of the diversions I mentally took while reviewing the NYT article; a near impossibility in the bar, but more importantly something I wouldn’t be drawn to consider.

Some other things… the arrow heads allow us to easily identify that Greece and the US have the two primarily outward facing imbalances, while Japan and France have easily the most inward facing imbalances. This ALMOST appears in the bar (Japan and France have very sparse third columns), but the ratio of in-balances to out-balances is difficult to derive for the other countries.

Also, the color of the lines is valuable beyond the “danger” circles in the bar. This could be fixed in the bar by coloring the third chart by the level of danger and then reorganizing by debt owed FROM rather than debt owed TO. For example, the incoming lines to France are imbalanced by high danger lines… it’s debt imbalance is problematic. Japan’s imbalance is outweighed by the US and Germany, which are low risk — all the high risk lines to Japan are thin. I think this is a fascinating story which is simply not told in the bar chart. Germany and Britain’s inflows bear similar stories.

So I’m happy with the arrows and circles and web-like feel. They evoke more stories and display quantifiable information in a way that I truly think exceeds the aggregate value of the bars, even if the issues with the definitions and legend were fixed.

I find myself strangely enough having to agree with Gert Nielsen on this comparison. I don’t think both versions are mutually exclusive, and in fact you could argue that the second (by Thomas Watkins) could be a complementary and augmenting view of the first (by Bill Marsh).

As it pertains to the original goal of the piece – to expose the entanglement and interconnectedness of the Euro Crisis – the first version achieves this in a much more eloquent way. It not only provides a qualitative view of individual countries (nodes) and a comparative debt analysis between its immediate neighbors, but most importantly, it offers a holistic network-view of the problem, the “web of debt” as alluded by the authors. I should also add that the use of color and spatial arrangement are intelligently employed.

Even though it succeeds in depicting the GDP and Debt minutia in columns 1 & 2, Thomas’ version fails unequivocally in trying to provide any sense of a broad understanding of the problem. In many ways, column 3 is an example of when not to use bar charts. The repetition of names/bars makes it hard to read and almost impossible to establish any type of relevant pattern or comparison.

Chip and Manuel,

You guys are forcing me to review the NY Times’ diagram more closely than my eyes find tolerable, but I’ll give it a shot. When Thomas asked me about the diagram originally, I took a quick look and found my eyes crossing, so I encouraged him to sort through the confusion. What he created as a result drew me into the story in a way that the original node-link diagram never would have.

Before diving into some of the issues that you raise, let me make clear to others who are reading this that Thomas’ visualization is his replacement of the diagram that appeared in the NY Times only, not a replacement for the entire story. Thomas is not arguing that his visualization can stand alone without textual narrative. Words would be used to dispel any confusion that readers might have about terms such as Debt-to-GDP ratio.

It is true that Thomas’ visualization does not represent the web of connections, nor does it try to do this more than minimally. Thomas found the original diagram confusing but considered the information that it contained important, so he decided to redo it to better understand the story of debt between Euro-zone countries and the U.S. He produced a simple visualization that allowed him to view (1) each country’s size in GDP as important context when comparing the countries, (2) each country’s debt to GDP ratio to understand the magnitude of debt in relation to each country’s ability to payoff its debt, and (3) the amount of debt that each country owes to its debtors to compare their relative proportions and to get a sense of the interconnections between countries. He created a visualization that enabled all of this to be done graphically, without having to clutter the display with the many numbers that appear in the original diagram. When he sent his visualization to me, my eyes were immediately drawn to do what they refused to do when I saw the original diagram: they compared the different measures of debt to learn the degree to which these countries are indebted and the amounts that they owe to one another. I came away from this quick and simple review understanding a story that I would have never discovered in the original diagram, because I had no interest in following the tangle of lines, comparing the sizes of circles, and reading tiny numbers spread all around the screen.

By using a node-link diagram, the NY Times version conveys the sense of connectedness, but not the full web of connections that I expected given the tangle of lines. It only represents the imbalances of debt between countries, not the full web of payer and payee connections. A different type of network diagram, such as one that arranges countries in a circle and shows bidirectional debt relationships between them using line with arrows or varying widths would represent the web of connections much better. As it is, with some effort I can distinguish countries that have more arrows pointing to them from other countries than arrows pointing away from them to other countries, which gives me a sense of the relationship of each country’s payer-to-payee balance, which is something that Thomas’ version doesn’t address. This information could be easily added to Thomas’ visualization, however, in the form of a simple series of bars that run to the right or left of zero for the balance of debt owed (positive values) or owed to (negative values) each country. Some of the other revisions to Thomas’ visualization that you have recommended might indeed improve it, enabling it to tell a richer story in a way that all readers could understand.

One of my recurring objections to many infographics is the assumption by the creator that the entire story should be told using a single chart. Attempting to make this work is a fun challenge for an infographic designer, but it often produces a nightmare of confusion for the information consumer. Using this NY Times graphic as an example, readers are required to unravel an intricate web and make comparisons based on 2-D areas, which are difficult to decode, all while their eyes are being assaulted by a tangle of lines and arrows. Thomas attempted to break the story into its parts and then communicate each part in a simple way, and to do so in a way that allowed comparisons between the parts of the story (each column of bars) to see how they relate.

You who spend a lot of time making complex network visualizations forget that most people find them difficult and confusing. Don’t allow your familiarity with them allow you to forget the needs of your audience. Many of you also assume that readers, such as those who read the NY Times, prefer pretty circles and lines to more familiar and perceptually accessible forms of display such as bar graphs. On what evidence do you base this assumption? What readers find visually engaging at first glance is not necessarily what they find most useful when they wish to understand the information.

This is all I can say for now. I’m getting ready to fly to Australia today for two weeks of teaching down under.

I’m interested to hear reaction on this related, more interactive chart from the web version of this story. http://www.nytimes.com/interactive/2011/10/23/sunday-review/an-overview-of-the-euro-crisis.html

Have a nice trip, Stephen, I look forward to your comments when you get a chance.

In the mean time, I didn’t mean to be particularly critical of Thomas’ execution; it is a very good chart for what it reveals… I think the main comments I made were based on my response to:

“I think The New York Times editing staff realized this, because they offer a fairly lengthy breakdown demystifying the visualization.”

And I was arguing that the breakdown probably isn’t much shorter for the bar chart version, so the criticism against the NYT version seemed to be unevenly leveled.

I think it’s important also, when you say “Many of you also assume that readers, such as those who read the NY Times, prefer pretty circles and lines to more familiar and perceptually accessible forms of display such as bar graphs” to not make the opposite assumption:

Thomas’ version may be preferable to policy makers or investment analysts who are interested in the straight numbers comparison; no doubt those people are amongst the NYT’s readership, or to people who prefer quantifiable information and hard numbers to “pretty pictures”; I’d think it’s equally possible that “we who spend a lot of time” “forget that most people find them difficult and confusing”.

Chip,

I appreciate your perspective and thoughtful comments. When I warned that creators of infographics should not assume that people prefer pretty circles, etc., rather than more effective forms of display such as bar graphs, I was merely pointing out an untested assumption that many graphic artists us to defend their choices. Personally, I’m not terribly concerned with people’s immediate preferences. At first glance, people are drawn to a visualization based on System 1 thinking (fast, intuitive, heavily reliant on heuristics, and emotional). What appeals to them based on System 1 thinking is often not what will appeal to them based on System 2 thinking (slow, reflective, more logical and analytical). The type of thinking that is needed when we view information in a visualization, assuming that we want to understand it and potentially use it to inform decisions,is System 2 thinking. Regardless of what we prefer based on an initial gut reaction, for purposes of data sensemaking we need to engage in System 2 thinking, which will find a visualization that displays data in the most accessible, clear, accurate, and meaningful way possible the most useful.

Hi again –

You’re correct that I base my preferences on opinion, emotion, gut feeling … That’s probably one of the reasons, why I ended up doing newspapers, while you ended up in business and academia ;-)

I’m not going to explain it more for now, especially as Chip and Manuel already did so well.

Just a note, even if I for a couple of years imposed a ban on bar charts, while I was graphics editor – to force us into experimenting with everything else – I don’t hold the view, that bargraphs should not be used in journalistic graphics. In fact I made a small one just yesterday.

Stephen, I hope you have a great trip down under.

Addressing your points in reverse order:

1. You stated: “Many of you also assume that readers, such as those who read the NY Times, prefer pretty circles and lines to more familiar and perceptually accessible forms of display such as bar graphs. (…) What readers find visually engaging at first glance is not necessarily what they find most useful when they wish to understand the information.” Not entirely sure how such assumptions could be extracted from my single comment. Also, I can reassure you I would never use a supporting argument alluding to “pretty circles”, or the preference for “visually engaging” elements, as the single justification for my preference.

2. There’s certainly a readability threshold in many graph visualizations, which is widely acknowledged, but this one in particular is within a very tolerable limit.

3. When you say that “Thomas attempted to break the story into its parts and then communicate each part in a simple way”, it merely reveals a blunt disregard for the goal of the piece and its accompanying story. If you reframe its objective and remove it from its original context, there’s no question on how a myriad of alternative methods could be employed to satisfy different questions. However, that’s not what’s at stake here. The reductionist approach taken by Thomas (distilling it to its individual parts) is an antithesis of the systemic overview of the Euro debt interdependence, conveyed in the story and eloquently portrayed in the initial diagram. This critical overlook of the original purpose is the main reason I’m contesting the premise of this post.

4. In reference to Thomas’ goal of showing “the amount of debt that each country owes to its debtors to compare their relative proportions and to get a sense of the interconnections between countries.” I would argue it fails redundantly on the last part. Can you explain to me how one is able to “get a sense of the interconnections between countries” on Thomas’ piece? If you are referring to the list rendered on the third column, it’s rather scribbled and fails to holistically convey any relevant pattern or comparison, let alone a sense of interconnectedness between countries. Chip does in fact make this point very persuasively: “Try, for example to find a loop in the NYT model (where country A is imbalanced to country B is imbalanced to country C is imbalanced back to country A). That was one of the diversions I mentally took while reviewing the NYT article; a near impossibility in the bar”.

5. You also mention: “Thomas’ visualization is his replacement of the diagram that appeared in the NY Times only, not a replacement for the entire story. Thomas is not arguing that his visualization can stand alone without textual narrative.” I would again claim that the alternative piece by Thomas ignores the entire accompanying story (or central story, depending on your point of view), by concentrating on its individual parts, instead of an all-inclusive “web of debt”, showing in a true systemic approach how the whole is more than the sum of its parts. The central message of this NYT article is that the Euro debt echoes through an unfolding network of interdependencies. “The global financial system is highly interconnected.” state the reporters in the very beginning, “So problems in one part of the world can reverberate almost everywhere else – risking a cascade of default, contagion, contracting credit and collapsing economic activity.” I would be immensely grateful if someone could explain to me how Thomas’ piece showcases this interdependence in a more intelligible way than the persuasive network diagram by Bill Marsh.

Manuel,

Thanks for adding your perspective to this discussion. As an expert in network visualizations, however, which you certainly are, I wonder to what degree you represent the perspective of most NY Times readers. Not everyone finds network visuzliations as inherently interesting as you do, nor do they find them easy to unravel. I’ve tried to respond to your points by number below and have done so quickly, so forgive me if I’m less articulate or thorough than usual.

1. I didn’t make this comment about pretty circles, etc., in response to anything that you wrote and I do not assume that you fall into the camp that promotes this perspective.

2. I don’t agree that the original network diagram falls within the tolerable limit for most readers of the NY Times. I think it’s possible that, because you live and breathe complex network diagrams, your notion of what’s tolerable to most people is off the mark. I personally found this diagram intolerable, despite my familiarity with them, given how much more accessibly the information could have been displayed.

3. I don’t agree that the NY Times diagram represented the intended story well, nor do I agree that Thomas’ visualization reduced the story in a significant way. Thomas’ version supplements the text more meaningfully and usefully than the original diagram. In the original diagram’s attempt to display the interconnectedness, it compromised the representation of debt values by displaying them in suboptimal ways.

4. If by “scribbled” you mean that the bars and text are small, if you blow it up to the size that is required for the original diagram to be legible, the bars and text are no longer too small. Thomas could have expressed these debts as percentages of the whole owed by each country rather than in dollars using a common quantitative scale, which might have worked better, at least for some purposes. I believe that your example of finding “a loop in the NYT model (where country A is imbalanced to country B is imbalanced to country C is imbalanced back to country A)”, which you enjoyed tracing as a light diversion but makes my head hurt just thinking about it, illustrates the degree to which you are perhaps out of touch with the people who read these articles. You, as someone who takes pleasure in thinking about the nature of networks and tracing the development of network representations throughout history, as you do in your book, are not typical of NY Times readers.

5. The original diagram does not actually show how “the whole is more than a sum of its parts.” Instead, it suggests that there is a complicated set of debt interconnections that few people will take the time to trace. The words that you quote from the story describes this interconnectedness in a way that the diagram fails to do. While reading the story, I found that, after being informed in words that the nature of debt is highly interconnected, I wanted graphics to help me compare the sizes of debt and the amounts that are owed by various countries to others. By focusing on the interconnectedness in his graphic, Bill Marsh created a diagram that could not be used to make these simple comparisons that can be easily made with Thomas’ visualization. Even you, with your expertise in reading network diagrams, could not rely on the original diagram to easily make these comparisons.

Hi again,

Of note, when you were telling Manuel “…illustrates the degree to which you are perhaps out of touch with the people who read these articles”, I think you were referring to a comment I wrote, so you may need to redo #4 (I haven’t yet written a book on network representations through history). I admit the example was a bit esoteric, but that’s why I called it a diversion.

If it’s too much, though, there are more interesting, simple, and relevant questions that I think people WOULD ask, that are part of the story, that the NYT visualization answers, by itself, and which the bar graph obfuscates. For example:

Why is France in any danger at all?

Why is Spain NOT in as much danger as Italy?

Why is Italy in the highest danger category?

Why are Germany and Britain not in danger?

When you say “I don’t agree that the NY Times diagram represented the intended story well, nor do I agree that Thomas’ visualization reduced the story in a significant way.” I think these are very good examples of why I do agree. For one thing, these questions are more indicative of the “intended story” than “Who does Greece have a worse imbalance worth: Spain or Britain” — it’s a nearly irrelevant question to the story, but the bar chart does a good job answering it.

The bar chart does nothing to tell the story of France — it’s the bar chart’s biggest failure in my opinion. France has imbalanced debt to only one country (Britain) in the bar chart, it has a low debt-to-gdp ratio, and it has a mid-sized economy — this does nothing to indicate a problem. The reason it is in trouble is because it has funded proportionally too much of Italy’s and Spain’s debt — this is obvious from the nyt chart with no tracing or eyestrain — there’s a big red line and a big ugly-yellow line; the good imbalances don’t outweigh the good imbalances; clear indicators that bad things are happening. This story is clear on the diagram and just isn’t there on the bar chart.

Italy is a similar story, and for the same reason as France (which is clear from the NYT chart)… the bar chart isn’t as bad in this instance, but compare Italy to Britain… they’re next to each other on the bar (so their economies are similar in size)… the debt-to-gdp is similar — (Italy’s is above the 100% line), Britain actually has MORE debt imbalance to spain and germany. So why is Italy so much worse off? The diagram answers this but the bar doesn’t: Britain has sizeable inflows and outflows of debt imbalance, for one thing (very apparent on the NYT visualization), and it has a favorable imbalance with the US (a fact which you have to dig to find on the bar in a very non-intuitive way).

These questions don’t require complicated tracing; one needs only focus on the country in question. The size of the country itself, percent of gdp-to-debt, and the color and size of its inflows and outflows are right there in and around the circle, very visual, it’s easy to see what’s coming in, what’s going out, which are the important imbalances — it represents the story.

Chip,

Are you basically arguing that the interconnectedness of the European debt crisis is BEST visualized by big colorful circles orbiting a dense network of smaller circles intertwined with colorful swirling arrows?

Correction to the above comment:

“WOULD you argue…”

It is important to consider purpose. One of the purposes of a newspaper is to entertain – hence crossword puzzles and Sudoku. The NYT version entertains as well as informs. As such it is appropriate for and popular with those readers with the time, desire and diligence to unravel gratuitous little mysteries. (I’m given to understand that NY city is teeming with such people.)

I know some who buy The Guardian daily for the visualisations and spend their lunch hour staining colourful pages with morsels of tuna fish from sandwiches and drips of coffee as they try to decipher baffling depictions of the Arab Spring, costs of public education, and why England can’t win the World Cup. It leaves me cold.

On the other hand, I find Thomas’s display ordered, coherent and informative. For a citizen merely wishing to be informed is far superior.

@Thomas – I’m sure I wouldn’t say it quite that way. To be fair, it sounds like your making fun of the NYT diagram the way you treat it … “big colorful circles” “dense network” “colorful swirling arrows” — I think it deserves a fair countenancde.

If I were to rephrase and say that a “network diagram is a reasonable choice for displaying a network of connections” it doesn’t sound as silly. Color is a good way to show risk in this diagram. Size is a reasonable way to show relative GDP. Arrows are a good way to show relationships (particularly ones where bi-direction is important, the main benefit I’ve argued that the diagram has). The size of the arrows is helpful in explaining the relative imbalances.

But no, I’m not saying that this is the de-facto “best” way to display the information. I think it’s pretty good at telling the story that the article tries to tell.

Again I point you to the questions I asked before such as “Why is france at all in danger?”. Could this story be told in a non-network chart? Probably – I’m amazed by people’s ingenuity; I’ve mentioned some changes to your bar chart that I think would help — leverage the danger colors more for the bars instead of as a separate section, and possibly reorder or duplicate column three to account for both inward and outward imbalances.

Again, I don’t mean to be critical. The quantitative information is in your bar, no question, and as Stephen said it’s a lot of work to get something like that put together, and I applaud the work. I just think it falls short of being superior to the NYT diagram, although that was the stated intent. Is it easier to read for the information it focuses on? Yes! It just misses the focus sometimes and therefore doesn’t tell the story — again, see France and my questions before for an example.

I have to say that the broad generalizations and empty assumptions on the reading patterns of millions of NYT readers are not just ineffective, but simply digressional from the central question that’s being asked here.

As stated before, Thomas’ version has its own merits and could certainly be a complementary view of the original diagram, but if the question is: which execution succeeds best at portraying the unfolding network of interdependencies or “web of debt”—this is after all the core of the story—then Thomas’ version fails by comparison. Chip has again explained quite persuasively why that is the case, by exposing a set of relationships only revealed by the original graph. I would even argue that Chip’s example of finding a “loop in the NYT model (where country A is imbalanced to country B is imbalanced to country C is imbalanced back to country A)” is far more than a light diversion, but a critical type of inquiry facilitated by Bill Marsh’s network diagram and impossible to ascertain in Thomas’ subsequent version.

The main problem was the reductionist approach taken by Thomas, who as Stephen explains, “attempted to break the story into its parts and then communicate each part in a simple way”. This methodology is the exact antithesis of any systemic analysis of a network structure, and while arguably able to answer a set of new questions, Thomas’ approach detached itself from the central inquiries driving the story and the original purpose of its accompanying diagram.

Since it’s only from the problem domain (goal) that we can determine which execution is better suited and easier to understand, I’m still left to wonder how one is able to “get a sense of the interconnections between countries” on Thomas’ piece? Bill Marsh’s version does accomplish the original objective with great eloquence and simplicity. That’s not to say there are not alternative versions that could potentially depict this intertwined network of dependencies in a better way, but Thomas’ is simply not one of them.

Manuel,

You are too quick to dismiss what you call my “broad generalizations and empty assumptions on the reading patterns of millions of NYT readers.” The question, “Are network visualizations an effective way to communicate to New York Times’ readers?” is central to this debate. An infographic must communicate to the intended audience. When Matt Ericson of the New York Times gave the infovis keynote address at VisWeek 2007, he said that they avoid scatter plots because most of their readers don’t understand them. At least at that time they tried to be aware of their readers’ level of graphicacy. When I, based on many years of working directly with people who are typical of New York Times readers, say that I think most of them would find a network diagram like the one we’re discussing difficult to read, it isn’t an “empty assumption” and it certainly isn’t “digressional from the central question that’s being asked here.” I make this point, in part, because the question, “Does this really work for my readers?” (not “Do they like it” but “Does it communicate effectively?”), is too seldom asked and almost never tested. I believe that in your book you should have asked this question of the network visualizations that you showcased. Until the creators of graphics ask this question seriously, the effectiveness of their work will suffer, and even worse, their readers will fail to get what they need.

I am not questioning whether network visualizations are useful. They attempt to provide a synthesis that cannot be seen by breaking information into its parts. I am questioning whether static network visualizations like the one we’re discussing communicate to the intended audience. I believe that they rarely do, and that the better way to tell the story once it’s discovered is through the use of words, supplemented by graphics that break the story down into digestible chunks. In fact, I believe that network visualizations are rarely useful, except those that are very simple, for any purpose without the ability to interact with them to alter the view (filtering, highlighting subsets, grouping in various ways, etc.)—that is to break it down into digestible chunks within the context of the whole.

As I’ve written previously, Thomas’ visualization did not attempt to display the network of interconnections. Instead, he displayed specific connections. If Thomas had recreated the entire story, I believe he would have described its interconnected nature in words and then used his graphic to supplement it with specific connections and debt values in an accessible way. He would not have tried to describe the interconnections in detail, which could not be done in words and could only be done graphically for an audience that is trained to read network visualizations, which even then would only work if they’re given the appropriate means of interaction.

Chip,

The fact that you can trace informative connections in this network diagram is not the issue. The question is, “Is this static network diagram the most effective way to tell this story to readers of the New York Times?” I believe that it is not. I believe that few readers will take the time to look beyond the tangle of lines. I have no empirical data to back up my intuition, but my intuitions on these matters are based on a great deal of experience.

Chip,

I have a question for you. When you first read this article and saw the network diagram, did you explore the diagram in the ways that you have described to illustrate what a reader could potentially do with it, or did you only explore it in this way only after reading my blog? I’m asking, because I believe that few readers would actually examine this diagram in the ways that you’ve described. Perhaps even you, someone who is comfortable reading network diagrams, did not actually become engaged with it in this way, except when needed to defend its potential merits. I’m sure you see what I’m getting at. I’m not saying that one could not get from it what you’ve shown to be possible, but that few readers would ever bother, even if they weren’t intimidated by its complicated appearance.

Stephen, you ask several questions, without taking any time to answer mine, so, before I answer, can you please answer my simple question…

I believe I challenged that:

1. The story of “why is a country in danger” is a key part of the “story”

2. The bar chart does not explain why some countries are in danger and why others are not, while the diagram does — particularly France, but also others (see my previous post)

If the bar has made some parts of the data more accessible (which I don’t necessarily concede anyway) at the sacrifice of this part of the story, then I’m simply arguing that it’s reasonable to believe the sacrifice is too great.

So again: compare the diagram to the bar chart and explain how they tell the story of France: why is it in danger? Am I incorrect in saying that the bar fails to tell that story as well as the diagram?

To quickly address your question, though: Even if some people don’t take the time to digest the diagram, being able to digest the chart more quickly is immaterial if the story isn’t there in the first place.

Chip,

If the story is there, it doesn’t matter if no one will bother to unravel it or can’t manage to if they try.

I actually have answered your questions, but have done so in general. I haven’t argued that every aspect of the story resides in Thomas’ visualization. Pointing out that particular parts of the story are not there misses the point. I’ve added a new “Note from the author” section to my original post, which attempts to clarify my concern with the original network visualization there.

In your “to quickly address your question” remark, you didn’t actually answer my question that I asked. My question is relevant. If even you didn’t bother to examine the original network diagram in the way that you’ve said it could be examined, your own response illustrates the concern that I’m expressing. Readers of news stories would rarely give a network diagram like this more than a glance unless pressured for some reason to do the work that’s required to make sense of it. You did the work to counter my critique. How much less likely are readers who are not familiar with network diagrams to actually unravel them? Even under duress, how many readers would be able to make sense of it?

Stephen,

I do feel Chip and myself have explained quite coherently why we don’t agree with the original premise of this post, and I’m genuinely concerned about the circular nature of this debate and the danger of falling into a continuous reiteration of the same arguments.

Any subjective insight of the type expressed by you or Sally on how millions of NYT readers interpret and unravel the original graph can only be translated as “broad generalizations and empty assumptions”, even if they’re unequivocally based on years of experience. By the same token, I could assertively say that many NYT readers are smart, inquisitive, and prone to the type of exploration exposed by Chip and only afforded by the original diagram. But due to its subjective and unsubstantiated nature, this line of argumentation is merely digressional, and I wouldn’t certainly make it the basis of my reasoning.

You pose this very startling question: “Are network visualizations an effective way to communicate to New York Times’ readers?” Subjective views aside, I see no reason why they shouldn’t, particularly when mapping relational datasets. The New York Times has employed similar methods in the past and has done it again with great eloquence. As stated before, there’s an undeniable readability threshold in many graph visualizations, which is widely acknowledged, but this one in particular (with just 10 nodes) is within a very tolerable limit.

You certainly don’t need to convince anyone here on the importance of understanding the intended audience, its immediate context, and expressed needs. But as previously admitted, in the absence of substantiated data on end users, the only honest way to determine which execution is better suited and easier to understand is by contemplating its original deliberate goal.

[I have to apologize for the blunt reiteration of previous points in the following paragraphs, but they are central to my disagreement]

–

Thomas’ version has its own merits and could certainly be a complementary view of the original diagram, but if the question is: which execution succeeds best at portraying the unfolding network of interdependencies or “web of debt”—this is after all the core of the story—then Thomas’ version fails by comparison. Chip has again explained quite persuasively why that is the case, by exposing a set of relationships only revealed by the original graph. I would even argue that Chip’s example of finding a “loop in the NYT model (where country A is imbalanced to country B is imbalanced to country C is imbalanced back to country A)” is far more than a light diversion, but a critical type of inquiry facilitated by Bill Marsh’s network diagram and impossible to ascertain in Thomas’ subsequent version.

The main problem was the reductionist approach taken by Thomas, who as you explained, “attempted to break the story into its parts and then communicate each part in a simple way”. This methodology is the exact antithesis of any systemic analysis of a network structure, and while arguably able to answer a set of new questions, Thomas’ version detached itself from the central inquiries driving the story and the original purpose of its accompanying diagram.

Bill Marsh’s version does accomplish the original objective with great eloquence and simplicity. That’s not to say there are not alternative versions that could potentially depict this intertwined network of dependencies in a better way, but Thomas’ is simply not one of them.

–

Finally, you make a really good point on the need for interactivity. I have always been an advocate of interactive techniques, not just as a key differentiator of information visualization (we can leave this notion for a separate debate), but also as a vital mechanism in the representation of complex networks. Even though I feel the requirement is not crucial in this particular case, it’s important to highlight (thanks Josh for the tip) that the authors have in fact produced an interactive version of the original diagram, where amongst other things one is able to explore subsets of the network as digestible chunks, while also following a deliberate story line:

http://www.nytimes.com/interactive/2011/10/23/sunday-review/an-overview-of-the-euro-crisis.html

In light of this, and acknowledging your approving view of interactivity, do you consider this a better version than the original static execution? And more importantly, do you still think Thomas’ piece is superior to both (static and interactive) in representing the unfolding network of interdependencies?

Manuel,

This debate has certainly been repetitive, but not circular in reasoning. I’ve expressed the concern that most readers of news stories, including readers of the New York Times, do not bother to unravel node-and-link network diagrams and would have a difficult time doing so if they tried. In expressing this concern, I am not questioning the intelligence of those readers, as you suggest. Their inability to decipher network diagrams as well as you do is based on unfamiliarity and lack of experience. In addition to this, however, is the difficulty that all humans have deciphering complex network diagrams unless they have the means to focus on individual parts one at a time, which is difficult to do with a static diagram.

Your intuition that readers find static network diagrams in news stories useful and my intuition that they don’t differ because our experience is different. I’ve worked for over 25 years with people that I believe are fairly typical of New York Times readers. Based on your experience of fewer years, I suspect that you are less in touch with this audience. Also, I believe that your nearly exclusive focus on network visualizations makes it difficult for you to see them as people without your interest, focus, and experience see them.

Your statement that “in the absence of substantiated data on end users, the only honest way to determine which execution is better suited and easier to understand is by contemplating its original deliberate goal” is illogical. If it is true that the interest and abilities of the audience must be considered, we cannot determine which graphical approach is more effective without taking the audience into account. If you don’t trust that my intuitive sense that New York Times readers don’t actually examine network diagrams beyond a brief glance and would struggle to understand them if they tried, then as an advocate of network diagrams you should investigate the matter. I just read a research study that assessed the ability of intelligent people to correctly interpret relatively simple graphs and found the number of errors that they made surprising. Knowledge of research such as this and direct experience with many thousands of students and clients have taught me to keep things simple, especially when presenting information to a general audience such as readers of news stories.

I have stated several times that Thomas’ graphic did not attempt to address all of the “interdependencies” of Euro zone debts. Pointing out, as Chip does, that some interdependencies can be discerned in the original network diagram, if you take the time and know how to read it, that are not addressed by Thomas’ visualization is beside the point. This is not a matter of contention. What I do contend is that Thomas’ version graphically presents useful information about Euro zone debt in a way that complements the story and is easy to understand, and is therefore more useful to readers.

Breaking a story into its parts is not “the exact antithesis of any systemic analysis of a network structure.” While it true that an analysis of a network structure requires a view of the whole, the examination of the structure involves a series of simpler views of its parts. Thomas’ approach left the overview that the network diagram attempted to provide to that part of the story that could be better told in words and chose to presents those parts of the story that could be better told graphically in a simple and effective visualization. I believe that few readers would care to examine the intricacies of this complex web of connections and that what they most readers would care to understand about it could be expressed more effectively in a few sentences.

I am not surprised that you agree with me that interactivity is needed to examine network visualizations effectively. I would take the time to review the online, interactive version of the story to let Josh and you know if I find it more useful, but I simply don’t have the time. What began as a simple blog post to show the work of one of my readers, Thomas Watkins, as a more useful alternative to the original network diagram, has ballooned into a lengthy discussion. I’m not complaining. This discussion has been useful. Unfortunately, however, I’m now in Melbourne and will be tied up for the next few days teaching daylong courses, which leave me exhausted at the end of the day. I suspect that, if I had the time to review the online version, given what you’ve said about it, I would find it much more useful than the static version that we have been discussing. More than that, I cannot say, which is unfortunate, because your question deserves an answer.

Thanks for your thoughtful contribution to my blog. I appreciate it and hope that I can return the favor some day.